Bill taxing certain online sales, with potential to boost education funding, passes House

SB 113 is now slated for governor’s consideration

ANCHORAGE, Alaska (KTUU) - A highly-debated tax bill focused on digitized businesses with customers in Alaska, and upon which a portion of education funding grants also hinges, passed the House in a 26-14 vote on Wednesday, setting the legislation up for consideration by the governor.

If it becomes law, Senate Bill 113 would change the state’s corporate tax law structure to — in part — include online sales from outside of the state, formally establishing that online sales to Alaskans equate to business conducted within the state. The legislation would also mean a change from the standard three-factor formula of sales, property and payroll, to a single sales factor formula, specifically for highly-digitized businesses.

Supporters have emphasized that the bill is a way to bring millions of dollars of additional revenue to Alaska, while opponents have expressed concern over potential costs to Alaskan businesses and consumers.

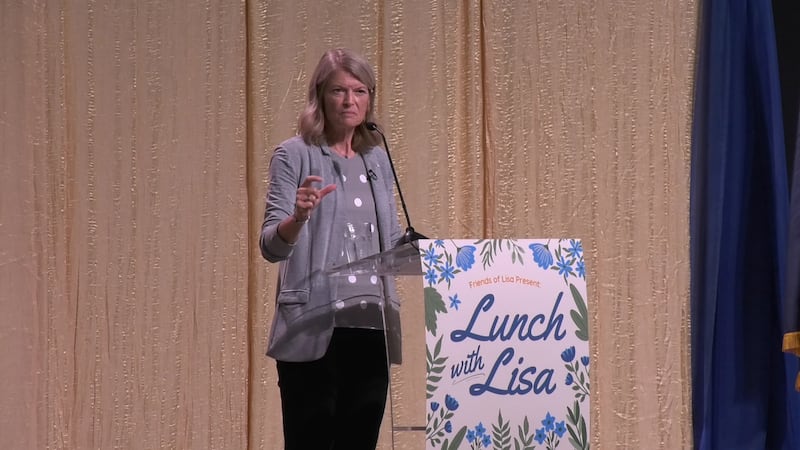

Sen. Bill Wielechowski, D-Anchorage, sponsored the bill and said in part upon its introduction in February that the bill “modernizes Alaska’s corporate income tax laws to address the realities of the digital economy by making two reforms,” adding that “[t]hese reforms will have little, if any, effect on consumer prices for Alaskans.”

At least 36 other states have made similar changes to their tax codes, he said, and only C-corporations would see structural tax changes with the way the bill is written right now.

“Much of the revenue that is generated from this bill will come from other states who are currently collecting the revenues that should be coming to Alaska,” he said during a recent press conference. “Alaskan brick and mortar businesses are picking up the cost for that [...] and that’s not fair. And so, this is about parity, also.”

While SB 113 passed the Senate 16-4 in mid-April, it wasn’t without intense debate that went so far as a motion in the House to table the bill just days ago. The May 5 vote on that failed 29-11, allowing SB 113 to go to third reading in the House on Wednesday.

Comment from lawmakers on the House floor Wednesday was limited, with only two legislators speaking to the bill.

Rep. Will Stapp, R-Fairbanks, referred to the bill as “a bit of a doozy” during Wednesday morning’s floor session while expressing support for the legislation. He emphasized that the bill would “bring our state more in line with the vast majority of states in the country,” specifically as it relates to corporate income tax.

“It is complicated,” Stapp said, adding that the bill would be the first structural change regarding corporate tax structure enacted in a long time, and that it would “modernize” Alaska’s corporate tax setup as a whole.

“On balance, there are plenty of reasons to vote ‘no’ on this bill; there are plenty of reasons to vote ‘yes’ on this bill,” he said.

One of the main alterations within the bill is the change to the majority of Alaska’s corporate income tax structure. It would be adjusted from a basis of cost of performance — which is based on the location of a taxpayer’s expenses versus the buyer’s — to market-based sourcing, which instead focuses primarily on the location of a taxpayer’s customers.

“Currently, the source of sales is determined using a methodology known as ‘cost of performance,’” Wielechowski explained in his sponsor statement, “that allows out-of-state corporations to argue that online sales occur in the state where the business is based, and are thus not subject to Alaska’s corporate income tax. Under market-based sourcing, sales would be apportioned to Alaska if the market for the sale was in Alaska.”

Alaska, being different from other states regarding this structure, “creates a bit of a problem,” Stapp said, adding that the bill would not only alleviate that, but would also generate revenue for the state over time.

“The Department of Revenue thinks [the bill] will raise anywhere from $10 million to $30 million, but they don’t know that,” Stapp said later in the floor session. “I hope that, ultimately, we can move to a single sales factor for the vast majority of Alaskan businesses, to put us more in line with other states.”

An attached fiscal note, dated April 9, 2025, indicates the state’s tax division believes the revenue generation could be as high as $65 million.

Rep. Jamie Allard, R-Eagle River, was the only lawmaker aside from Stapp who spoke on the legislation on the floor Wednesday. Citing a letter from the Alaska Chamber — which represents hundreds of businesses across the state — she claimed that the bill would “ultimately raise the price of goods.”

“‘To say this has no impact on Alaskans is untrue and disingenuous,’” she read in part, adding that costs would be passed on to consumers and businesses before adding her own comment to the record.

“A tax is a tax is a tax,” she said.

Wielechowski took to social media after the vote on Wednesday, calling the legislation a “common sense bill” and expressing frustration over Alaska lawmakers whom he said “think their job is to protect Outside tech billionaires at the expense of Alaskans.”

“Contrary to how some are attempting to spin this, this bill will NOT impact the vast majority of businesses that ship products into Alaska via Amazon or Etsy,” he wrote, “because most of those shippers are not C-corporations, and are unaffected by this bill.

“To reiterate,” he continued, “this bill does NOT change our corporate tax rates, does not increase taxes on Alaskan consumers or businesses and does not raise costs for Alaskans.”

The senator also emphasized the bill’s origination as being with Gov. Mike Dunleavy, whose administration he indicated had drafted similar legislation several years ago.

Wielechowski later brought forth SB 122 in 2023, during the 33rd Legislature, which mirrors the current version that passed on Wednesday.

Separate but now tied to SB 113 is House Bill 57, which evolved from primarily being a cell-phones-in-schools policy bill to legislation that now includes extensive funding for education across the state. A late amendment to the latter initially caused a return of the bill to the House from the Senate after advancement due to a technical error in the language of the bill, but was fixed and seeks to fund certain career and technical education programs and reading grants in Alaska, contingent upon the passage of SB 113.

At the time of the concurrence vote for HB 57, a couple of lawmakers changed their votes, stating in part that they did not agree with the reading grants being dependent upon SB 113’s advancement.

SB 113 passed the House Wednesday, and is now poised for consideration by the governor, skipping a concurrence vote, as it was approved as-is and without changes by the House. Dunleavy has 15 days to sign or veto the bill — with that deadline being beyond the final day of the regular session.

As such, the Senate Majority on Tuesday said that, realistically, the bill “would probably be something that we took up in January when we got back, or if there were a special session in the interim.”

HB 57 remains on Dunleavy‘s desk as of publishing time; the governor has not formally indicated whether or not he will sign that bill into law.

The last day of the regular legislative session is May 21, 2025.

Author’s note: This story has been updated to reflect the bill’s current status and to include additional reaction from lawmakers.

See a spelling or grammatical error? Report it to web@ktuu.com

Copyright 2025 KTUU. All rights reserved.